Pi Network Price Today: Stay Updated on the Latest Value

The Pi Network, a cryptocurrency project launched in 2019 by a team of Stanford graduates, has garnered significant attention due to its unique approach to mining and user engagement. Unlike traditional cryptocurrencies that require substantial computational power and energy consumption, Pi Network allows users to mine coins on their mobile devices with minimal resource usage. This innovative model has led to a growing user base, with millions of participants worldwide.

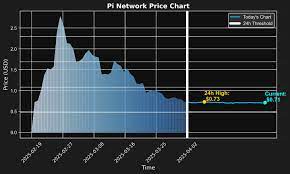

However, the price of Pi Network tokens remains a topic of intrigue and speculation, primarily because it is not yet listed on major exchanges, making it difficult to establish a concrete market value. The current price of Pi Network is largely theoretical, as it has not been traded on any public exchanges. Instead, the value is often discussed in terms of potential future worth based on user adoption, network growth, and the overall cryptocurrency market landscape.

As the project progresses towards its mainnet launch, the anticipation surrounding the price of Pi tokens intensifies. Investors and users alike are keen to understand how the price will evolve once trading begins and how it will compare to established cryptocurrencies like Bitcoin and Ethereum and eager to know pi network price today

Factors Affecting Pi Network Price

User Adoption and Community Backing

One of the most significant factors affecting the price of Pi Network tokens is user adoption. The more users that join the network and actively mine Pi coins, the greater the demand for these tokens may become. With over 35 million users, the network boasts a strong community backing. However, this number alone does not guarantee a high price; it must be coupled with active engagement and utility within the ecosystem.

Market Trends and Investor Confidence

The price of cryptocurrencies is often correlated with market trends and investor confidence. During bullish market conditions, new projects like Pi Network may see increased interest and speculative investment, driving up perceived value. Conversely, during bearish trends, even promising projects can suffer from diminished interest and lower valuations.

Regulatory Developments and Investor Sentiment

Regulatory developments can also impact investor sentiment significantly. Any news regarding regulations affecting cryptocurrencies can lead to rapid price fluctuations. As a result, the price of Pi Network tokens can be influenced by changes in regulatory environments and investor confidence in the cryptocurrency market.

How to Track Pi Network Price

Tracking the price of Pi Network tokens can be challenging due to their absence from major cryptocurrency exchanges. However, there are several methods that enthusiasts and investors can use to stay informed about potential price movements. One effective way is to follow official channels such as the Pi Network’s social media accounts and community forums.

These platforms often provide updates on project developments, partnerships, and milestones that could influence the token’s future value. Another method involves utilizing cryptocurrency tracking websites that monitor user sentiment and community engagement. While these platforms may not provide an official price due to the lack of trading activity, they can offer insights into how the community perceives the value of Pi tokens based on mining rates and user growth.

Additionally, some speculative trading platforms may allow users to trade Pi tokens in a limited capacity or offer predictions based on market analysis, providing another avenue for tracking potential price movements.

Predictions for Pi Network Price

Predicting the future price of Pi Network tokens is inherently speculative due to the project’s unique position in the cryptocurrency landscape. Analysts often consider various factors when making predictions, including user growth trends, technological advancements within the network, and broader market conditions. Some optimistic projections suggest that if Pi Network successfully transitions to a fully operational mainnet and establishes partnerships with businesses for real-world use cases, the token could see significant appreciation in value.

Conversely, there are more conservative predictions that caution against overestimating the potential price of Pi tokens. Skeptics argue that without a clear utility or demand for the tokens beyond speculative trading, their value may remain stagnant or even decline post-launch. The volatility inherent in cryptocurrency markets further complicates these predictions; sudden shifts in investor sentiment or regulatory changes could dramatically alter the trajectory of Pi Network’s price.

Investing in Pi Network: Is it a Good Idea?

Investing in Pi Network presents both opportunities and challenges for potential investors. On one hand, early adopters who have mined tokens since the project’s inception may stand to benefit significantly if the network gains traction and achieves widespread adoption. The low barrier to entry for mining on mobile devices has attracted a diverse user base, which could translate into a robust ecosystem if users find real-world applications for their tokens.

However, prospective investors should approach with caution. The lack of a clear market price and trading history makes it difficult to assess risk accurately. Additionally, as with any cryptocurrency investment, there is an inherent risk of loss due to market volatility and regulatory uncertainties.

Investors should conduct thorough research and consider their risk tolerance before committing funds to Pi Network or any other cryptocurrency project.

Comparing Pi Network Price to Other Cryptocurrencies

When evaluating the potential price of Pi Network tokens, it is essential to compare them with established cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). Bitcoin has long been regarded as a store of value and digital gold, while Ethereum has carved out a niche as a platform for decentralized applications (dApps) and smart contracts. Both have demonstrated resilience in various market conditions and have established ecosystems that support their value.

In contrast, Pi Network is still in its infancy regarding market presence and utility. While it boasts a large user base, its actual use cases remain largely theoretical until it transitions to its mainnet phase. This lack of established utility makes direct comparisons challenging; however, observing how other cryptocurrencies have evolved during their early stages can provide valuable insights into potential trajectories for Pi Network’s price.

Risks and Benefits of Pi Network Price Fluctuations

The price fluctuations of Pi Network tokens present both risks and benefits for investors and users alike. On one hand, volatility can create opportunities for profit; savvy traders may capitalize on short-term price movements if they can accurately predict trends based on market sentiment or news events. Additionally, if the network successfully launches its mainnet and garners significant user engagement, early adopters could see substantial returns on their investments.

On the other hand, volatility also poses significant risks. Sudden drops in price can lead to panic selling among investors who fear losing their initial investments. Furthermore, without a solid foundation of utility or demand for Pi tokens post-launch, there is a risk that prices could plummet if interest wanes or if regulatory challenges arise.

Investors must weigh these risks against potential rewards when considering their involvement with Pi Network.

Tips for Making Informed Decisions About Pi Network Investment

For those considering investing in Pi Network or any cryptocurrency project, several strategies can help ensure informed decision-making. First and foremost, conducting thorough research is crucial; understanding the project’s fundamentals, team background, technological innovations, and community engagement can provide valuable insights into its potential viability. Additionally, staying updated on market trends and news related to both Pi Network and the broader cryptocurrency landscape is essential.

Engaging with community forums and social media channels can help investors gauge sentiment and identify emerging trends that may impact prices. Finally, diversifying investments across multiple assets can mitigate risk; rather than putting all funds into one project like Pi Network, spreading investments across various cryptocurrencies can provide a buffer against volatility while still allowing for potential gains in promising projects.